What We Do

Our Services

Retirement Planning

Each person’s idea of retirement is different. While some people will never quit working, others may slow down, and others will stop working completely. Some want to travel, others want to garden. A few want to turn a hobby into a new business. Regardless of your personal circumstances, we can tailor a retirement and income plan to suit you, keeping in mind that safety, growth and income are not mutually exclusive.

Income Planning

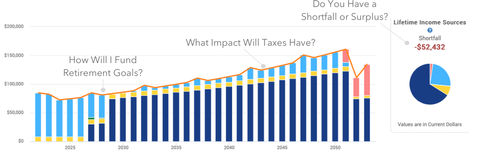

How do you make decisions for retirement? We believe math and data should drive every financial decision you make. We pride ourselves on building advanced and forward looking income plans for our clients. Doing so allows us to plan for and estimate where road blocks will emerge. We find this helps retirees fulfill the most important goal of all, a worry-free retirement.

Investment Planning

Our investment philosophy is that by protecting and preserving your money first, you will achieve greater overall returns. This takes precedence over market returns and as it turns out, this has been the right call. Chasing high returns at the risk of relinquishing market gains and invested principle is a formula for insanity.

Fees. Taxes. Investor Behavior. Tailored Allocations. Statistically, these are the four categories that drive investment performance.

Legacy Planning

For most families, wealth planning doesn't stop at the end of a retirement plan. Many retirees have an interest in leaving a legacy to heirs or causes they care about. This can be one of the most fulfilling goals a retiree undertakes. However, navigating the maze Uncle Sam has put in place to get his "fair share" can be difficult. A well-built legacy plan can maximize the amount that your heirs actually receive.

Contact Our Team

By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy. Safeguard Wealth Management relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Additionally, Safeguard Wealth Management or its affiliates do not provide tax advice and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Please see our Full Disclosure for important details.

Safeguard Wealth Management is a Registered Investment Advisor with the SEC.