FAQs

-

Can you re-explain your fees to me?

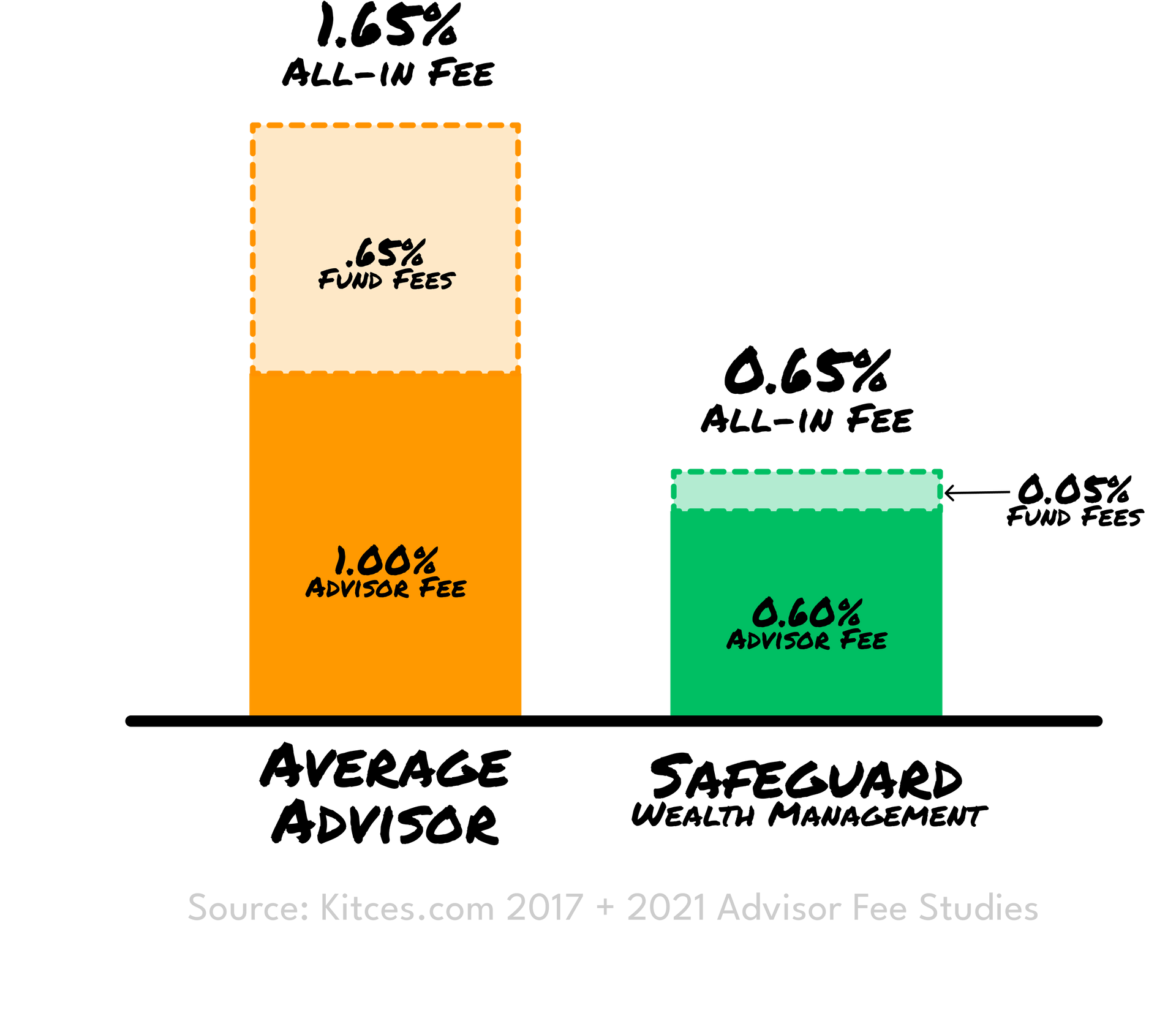

It is best to think of advisor fees in two categories.

The first is the advisory fee. This is what ultimately goes to the advisor. Our advisory fee is 0.60% regardless of account size. The national average for a $1 million account is 1% (higher for smaller accounts).

The second type of fees are the fund expenses. We use low-cost ETFs. Our diversified, tailored portfolios fall anywhere between 0.05% and 0.10% on average. In comparison, the national average is 0.65% for fund expenses.

In total, these fees add up to .65% (for Safeguard Wealth Management) vs. 1.65% (for national advisor average).

-

What is included in the fee?

Everything we do. From forward looking tax-planning to retirement income modeling to investment management. The 0.60% fee covers everything.

-

What are your models?

Traditionally, models are used to describe certain investors. For instance, a traditional advisor might have a conservative, moderate, and aggressive model. Every client fits in to one of those three models.

We do not use models. Every portfolio is tailored directly to the individual and their situation. We don't believe models make sense and are a disservice to what the client is actually paying the advisor for.

-

What kind of returns should I expect?

Returns on assets invested in the stock market or any other asset market are nearly impossible to predict and are out of your (and our) control.

However, there are things we can control, like the fees we pay. There are also mathematical processes we can implement to improve returns. Things like rebalancing, strategic diversification, tax-loss harvesting, fee coordination, etc.

Markets will take care of returns over the long term. The key is to stay disciplined and stick to your strategy in order to build wealth.

-

Are there costs associated with moving from my current advisor to Safeguard?

No, not on our end. We charge no set up fee or intial fee.

Depending on the arrangement with your current advisor, there may be costs on their end. We have strategies to help you avoid some of those costs .