Planning "Alpha"

How Likely Is Your Money To Last?

Statistically, this is the #1 question retirees have.

Despite this, how many of us actually feel like we have a quantifiable answer?

Every retirement plan we build is run through a Monte Carlo (a 1,000 trial test) to deliver a probability of success. A 93% probability of success means 930 of those 1,000 trials were successful based on the goals given.

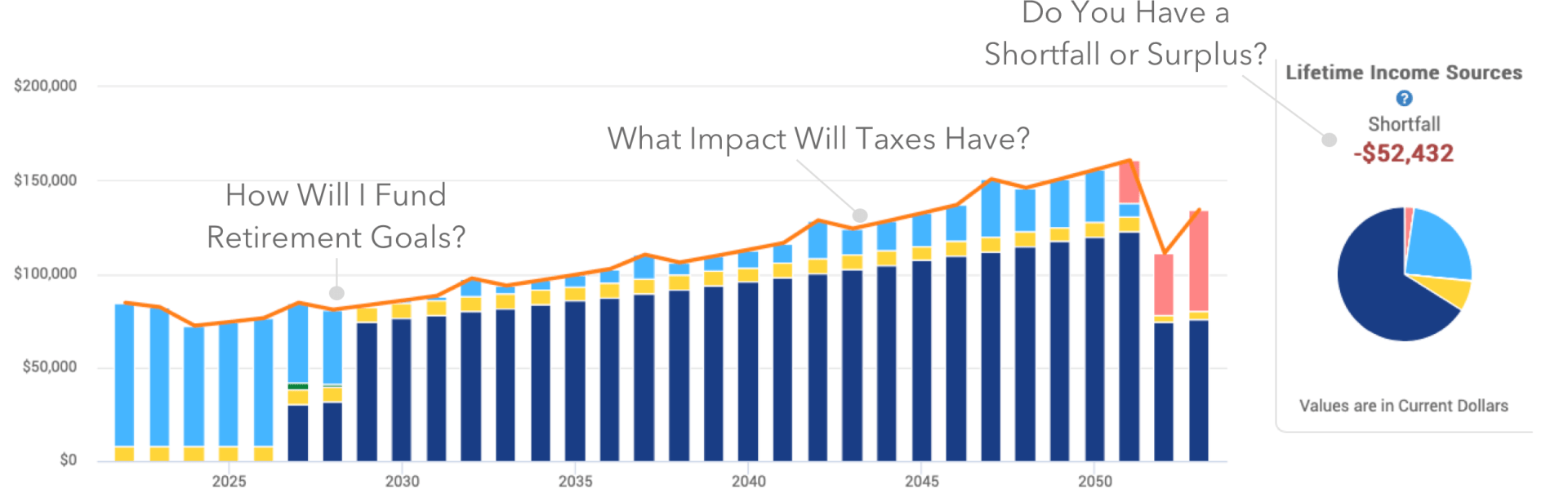

See the Impact Changes Have In Real Time

What if you decided to retire a year earlier? What effect would saving $1,000 more per year have?

Variables can be changed in your plan and illustrated back to you with the click of a button. Every adjustment can be quantified and illustrated back to the client. This puts you into the drivers seat.

How Fragile is Your Retirement Plan?

Do you ever find yourself awake at night, worrying about your retirement plan? Have I saved enough? What happens if Social Security benefits are cut? What happens if we see another Stock Market Crash like 2008?

These "What If" scenerios shouldn't keep you up at night. In fact, they should be included as part of your retirement plan. When we build retirement plans, we stress test each plan in over 10 different "stressed" scenerios. From higher taxes, to rising healthcare costs, to lower expected future returns.

The right retirement plan should withstand these tests. Does yours?

Maximizing Your (And Your Spouse's) Benefit

For many Americans, Social Security will be their largest retirement asset. Yet, over 90% of all recipients don't maximize their benefit. Advanced planning and coordinating your benefit with taxes and other assets can deliver a tremendous impact down the road.

Build a Forward-Looking Tax Plan

How do you plan for taxes? Around April do you simply bring in a shoebox full of receipts and statements to your accountant and let them wade through the mess?

Or do you plan for taxes well in advance?

The former may be acceptable during your working years but once you enter retirement, a reactive tax plan will cost you.

For most retirees, taxes will represent your largest expense in retirement. Yet most plans, and advisors, worry more about what stock fund you're invested in then the $10,000 tax bill you'll have at the end of the year.

How Fragile is Your Retirement Plan?

Do you ever find yourself awake at night, worrying about your retirement plan? Have I saved enough? What happens if Social Security benefits are cut? What happens if we see another Stock Market Crash like 2008?

These "What If" scenerios shouldn't keep you up at night. In fact, they should be included as part of your retirement plan. When we build retirement plans, we stress test each plan in over 10 different "stressed" scenerios. From higher taxes, to rising healthcare costs, to lower expected future returns.

The right retirement plan should withstand these tests. Does yours?