Blog Layout

4 Retirement Opportunities the Coronavirus has "Created"

Eric Sajdak • Mar 12, 2020

The Coronavirus is continuing to lead news headlines throughout this week as it grows in size, and we are gaining more data on it.

Global financial markets around the world have been rocked by COVID-19.

During times like these where we can physically see an increase in panic and fear in our daily lives, we often lose sight of the opportunities around us. In fact, during volatile periods like this, there are substantially more opportunities to take advantage than during calmer times.

In this quick article, we share with you four retirement opportunities that the Coronavirus has indirectly created for you.

1. Refinancing Your Mortgage and Other Debt

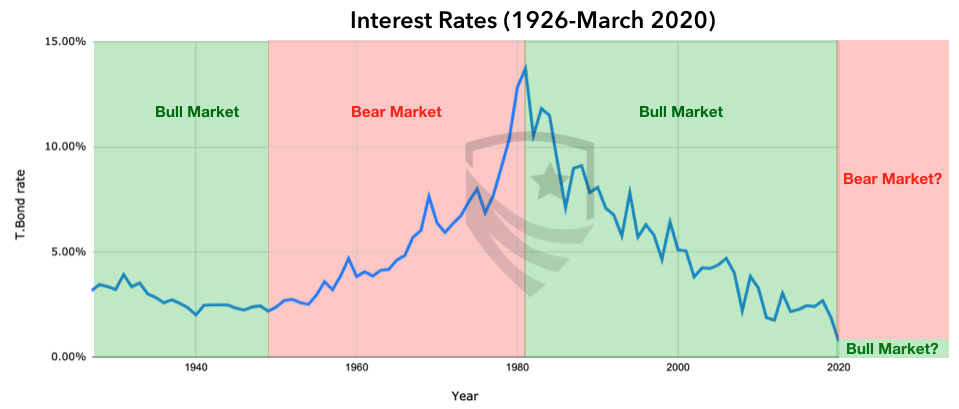

Interest rates have been plummeting during the past couple of weeks.

The 10-year Treasury began the year at 1.90% and has fallen to as low as 0.32%! This drop has been unprecedented in such a short time. This opens up a significant opportunity for those carrying a mortgage or other debt.

No one knows where interest rates are going from here. Maybe they will fall lower, and the case for a refinance will only get stronger. However, we are at all-time lows on the 10-year. For nearly everyone reading this article, refinancing now will translate to an apparent savings.

If you have been thinking about refinancing, we would recommend moving quickly. Tony and I both are refinancing our mortgages. We "locked-in" our rates one day apart. Tony locked his rate in at 2.75%, the next day I was at 3.25%*!

* Both on a 30-year mortgage

2. Dump Inflation Losing Assets

Before interest rates began plummeting, retirees were facing a low-yield investment world. After these rate drops, retirees are facing a really low-yield environment.

The good news?

If you owned bonds the past few weeks, this part of your portfolio has done exceptionally well. As interest rates fall, bond prices go up. This is why bonds have looked so attractive over the past 30 years.

The bad news?

As interest rates rise, bond prices go down. This bond bull market is likely ending. We are at all-time lows in rates. Probabilistically, a bond bear market is ahead of us. The last time we had a bond bear market, bonds had a real (inflation-adjusted) drawdown of -60%!

Can rates drop further? Of course. There are no hard and steady rules here. Rates continuing to drop are the only way fixed income looks like an "attractive" investment.

- Rates Fall: Bond returns are attractive a bit longer

- Rates Stay Unchanged: Bond yields are in the 0.5%-2% range. Losing to inflation.

- Rates Rise: Bond returns are negative. Bonds are a losing proposition both nominally and in real terms

Think about this:

Barclay's Aggregate Bond Index (a combination of long and short term bonds) is currently yielding 1.79%. According to the U.S. Bureau of Labor Statistics, 12-month inflation is 2.30%. We don't need a calculator to know that's a losing proposition.

If you're paying an advisor, planning on paying taxes, or have any other investment-related fees, this pushes your bond yield further into the red.

3. Tax Loss Harvesting

This opportunity is for investors with a taxable account. For those without one, you can skip to the next section.

Over the past two weeks, many of us do not want to look at our investment accounts. However, losses in your taxable account can benefit you. At least in terms of taxes.

Authors Note: There are a lot of rules around this strategy. Please consult with a CPA and financial professional before making any moves. Tax Loss Harvesting performed improperly will cost you money.

Here is a quick example of how Tax Loss Harvesting can increase your returns this year.

At the beginning of the year, I bought 100 shares of SPY (an S&P 500 ETF). My shares are currently down -13.5% on the year. I have a short term loss of -13.5% ($4,400). If I sell my shares, I realize the loss and will offset capital gains this year and/or ordinary income.

But of course, what happens if the market comes recovers?

Through tax loopholes, I can buyback a similar (but not identical) security. For this example, I can buy an S&P 100 ETF. The S&P 100 tracks (YTD: -13%) the S&P 500 extremely closely, but, in the eyes of the IRS is not identical.

What is the benefit of all of this?

Well, let's fast forward a year from now.

- If the market recovers: I will have realized a short term loss of $4,400 for tax purposes. However, my actual performance would be unchanged. In the 24% tax bracket, this is a tax savings this year of $1,000. When I eventually sell my new position, it will be a long term gain. LT gains are taxed at a lower capital gains rate, creating a tax arbitrage and increasing my return. All without changing my actual investment performance

- If the market goes lower: I could perform the tax loss strategy again if it makes sense or hold on to the investment and wait for a recovery

The result of this strategy is tax arbitrage. The exact savings will be different for everyone and will depend on a multitude of factors.

4. A Punch in the Gut Reminder

Lastly, the opportunity that volatility creates is the kick in the butt many of us needed. I don't mean to downplay what's happening. Losses in our retirement accounts are real. But an honest conversation needs to happen.

When things are going well and humming along, it's easy to fall prey the "we'll get to that eventually" mentality. A booming market and economy can be very forgiving.

Every day we analyze plans for prospective clients. Every situation is unique, but trends emerge over time.

For example, a stress test we perform for every plan we build is a Market Downturn test. Basically, what would happen to your retirement plan if the stock market fell by the long-term average of -39%? For a prospective client's current plan, this analysis can be sobering. Too often, we see investors taking an imbalanced amount of risk. The last two weeks expose this.

I don't know if the market/economy recovers from here or pushes lower. No one does (despite what you may hear in the news). Don't kick yourself if you were planning on making changes and "ran out of time".

We can only control what happens from here moving forward. Did we get the kick in the butt we needed?

For retirees, here are things we can control unrelated to the markets performance:

- Maximizing Your Social Security and Medicare Benefits

- Building a Forward-Looking Tax Plan to Maximize Your After-Tax Income

- Optimizing Your Withdrawal and Roth Conversion Strategies

- Paying Less in Fees

- Coordinating Our Assets to Save on Taxes Now and In the Future

- - - - - - - - - - - - - - - - - - - - - - - -

If you have questions on some of the strategies or opportunities in this post, please let us know below! Also, if you'd like to be added to our weekly email where we give strategies for improving your retirement simply responsd, "Weekly Email" in the message section below.

Have Questions on the Strategies in this Post?

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

By Eric Sajdak, ChFC®

•

07 Jul, 2020

"If I delay my Social Security benefit, at what age would I breakeven versus simply filing at 62?" We field this type of question frequently from retirees. The Social Security system allows you to file anytime between 62 and age 70. At first glance, filing at 62 seems to make the most sense. After all, there are 12 months in a year and eight years between ages 62 and 70—That's 96 months of monthly paychecks that you wouldn't be getting if you delayed. However, you get penalized for taking your benefit early. Below is a diagram showing the penalties and delayed credits for someone whose Full Retirement Age is 66:

By Tony Hellenbrand

•

30 Jun, 2020

Lately I’ve been getting asked how I was able to “Call the Bottom” in late March. I want to make something clear: I didn’t. If you go back and look at the article from March 16th or read the email I sent out to subscribers on the 26th, (pure dumb luck), I ran a bad case, a best case, and a base case valuation on the S&P 500. I arrived at a base case valuation of 2,950, and at the time the S&P was hovering around 2,300, so we started recommending clients initiate buying plans. These plans did not mean “This is the bottom” or “Go all in.” Far from it. Many of our clients were buying several days before the precise bottom, and several days and weeks after. Regardless of how clearly I try to make this point (that we simply were buying something the math said was likely cheap) this morning my inbox is chock full of people asking what I think about valuations now. Are we in a bubble? Is the market ahead of the fundamentals? Are we going to double dip? Will the market crash? Will we need a second stimulus? Maybe. I have no idea. Here’s what I know, when you accumulate all of the available earnings estimates and make a conservative estimate of fair value, you end up with a fair value of about 3,060 on the S&P 500. As I type this we sit at 3,080. Regardless of whether the number is 2,950 or 3,060 or 3,080 or 3,150, any way you slice it, we’re at fair value, now. Analyst Earnings Estimates:

By Eric Sajdak

•

28 May, 2020

It is your right as an American to (legally) pay the least amount in taxes that you owe—nothing more, nothing less. But in recent years, Congress has made a concerted effort to shift the IRS code and levy you with taxes you didn't even know you were paying. We call these "Stealth Taxes." These changes are never talked about by your congressman (or woman). They lie deep within the tax code and can potentially cost you significantly unless you learn about how to avoid them. In this article, we cover three of those "Stealth Taxes" and what you can do to minimize or avoid them altogether.

Contact Our Team

By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy. Safeguard Wealth Management relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Additionally, Safeguard Wealth Management or its affiliates do not provide tax advice and investors are encouraged to consult with their personal tax advisors.

All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Please see our Full Disclosure for important details.

Safeguard Wealth Management is a Registered Investment Advisor with the SEC.